Don’t Leave Profit On The Table

The vast majority of businesses owners in this country work hard, very hard. However, despite their best efforts, a lot of businesses never reach their full profit potential.

There’s no doubt, to create a successful business you need to do research and planning plus you need to take risks. There are very few shortcuts to success and no amount of enthusiasm, passion, talent or hard work can guarantee business success.

While there are a multitude of reasons why a business can fail, there are even more reasons why a business under-performs. The wrong product, incorrect pricing, a poor location and a lack of marketing can all drag down your bottom line profit. Bad timing and simply not minding your own business by maintaining quality financial records can also impact on your profit. Of course, some of these issues a business owner can control while others are out of your control including economic conditions, new technology or natural disasters.

Profit is how we keep the score in business and it is also a consequence of decisions made by management. The mission is to maximise your profit and when you sell your business, the valuation might also be a multiple of your profit so it’s important to continually grow your profits.

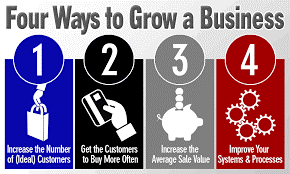

Fundamentally there are only four ways to grow your business and your profit:

-

Increase the Number of (Ideal) Customers

- Get the Customers to Buy More Often

- Increase the Average Sale Value

- Improve Your Systems & Processes

It doesn’t matter if you run a plumbing, painting or physiotherapy business, the first step in growing your business is to identify these 3 key numbers:

- Your number of customers

- How many times each year those customers transact with you

- The average customer sale value or transaction amount

To illustrate the point, let’s assume you run a hairdressing salon and your metrics are as follow:

| Number of Customers |

Average Transaction Value |

Average Transactions per Annum |

Equals Turnover |

| 250 |

$125 |

6 |

$187,500 |

It’s basic mathematics to arrive at the turnover figure of $187,500. They say you can only manage what you measure so it’s important that you know these three numbers in your business. If the business has rent of $50,000 plus wages of $45,000 and other costs of say $15,000 (including rates, insurance, repairs and consumable products) then the business profit would be $77,500. Assuming your business was valued at 2 times your profit (before interest and tax) it would be worth $155,000.

Now, using a software tool called the Business Accelerator Program, let’s look at the profit improvement potential in the business by increasing some of these key performance indicators.

The simplest example is increase your average sale price by 10% so it goes from $125 to $137.50. That might be as simple as putting your prices up, or alternatively, you start ‘up-selling’ so each customer buys some hair product on leaving the salon. Multiplying the numbers through, your turnover goes from $187,500 to $206,250. The $18,750 increase in revenue goes almost entirely to your bottom line profit.

Let’s now look at what happens if we can get an increase in more than one of your key performance indicators. If you could increase your number of customers by 10%, increase your prices by 10% and get your customers to come in for a haircut 7 times a year (instead of 6) what impact would that have on your business turnover and profit? As you’ll see below, the business turnover rises by an incredible 41% to $264,688. The compounding effect is massive!

| Number of Customers |

Average Transaction Value |

Average Transactions per Annum |

Equals Turnover |

| 275 |

$137.50 |

7 |

$264,688 |

With the extra number of haircuts, you might have to employ a part time hairdresser, so we will allow an extra $15,000 for wages and hair product you might consume delivering these services.

Punching these changes into the Business Accelerator Program you’ll find the business profit increases by $46,021 (59.38%) from $77,500 to $123,521.

Not only that, because of the profit improvement, the value of the business has increased by $138,063 from $232,500 to $370,563.

A 10% increase in price combined with a 10% increase in the number of customers plus getting customers to come and buy one extra time per year is probably achievable for any hairdresser.

Let’s now consider your business. Can you identify the 3 key performance indicators in your business? If not, we can certainly help you calculate your numbers and do some financial modelling to identify the profit improvement potential in your business. In doing so, you can set some financial targets for the next financial year and think about how you are going to attract more customers, get existing customers to spend more with you and buy from you more often. As accountants, we don’t want you leaving any potential profit on the table.

Of course, the financial calculations are easy when you know your key profit drivers. It’s easy to say you are going to attract 10% more customers next year but how do you do it?

Well, to support each of the 4 ways to grow a business we have developed a number of strategies. For example, here is a single strategy for

how to attract more customers, get them to buy more often and increase the average sale value.

Well, to support each of the 4 ways to grow a business we have developed a number of strategies. For example, here is a single strategy for

how to attract more customers, get them to buy more often and increase the average sale value.

![]() Get More Customers – Use Target Marketing. You don’t necessarily want to market to everyone so you need to focus

your attention on winning your ideal type of customer. This could mean targeting a certain gender, age group, income level or people in a

geographic location. The next question is, where do they ‘hang out’? It could be online and Facebook lets you target groups with ads based

on certain types of qualifying criteria (like age and location) so you can really hone in on your ideal type of customer with tailored

advertisements.

Get More Customers – Use Target Marketing. You don’t necessarily want to market to everyone so you need to focus

your attention on winning your ideal type of customer. This could mean targeting a certain gender, age group, income level or people in a

geographic location. The next question is, where do they ‘hang out’? It could be online and Facebook lets you target groups with ads based

on certain types of qualifying criteria (like age and location) so you can really hone in on your ideal type of customer with tailored

advertisements.

![]() Get Your Customers to Buy More Often - Customer retention is important because these people have bought from you

before, hopefully had a positive experience and simply need to be nurtured so they come back and buy again. It’s just poor business

practice to ignore an existing source of revenue that’s right under your nose and the nurturing process is designed to make customers feel

valued. Your communications are designed to help stay in touch (with newsletters and special offers) and keep your business top of mind.

Trades people rarely communicate with their clients beyond the first ‘sale’. Leaving a business card or fridge magnet behind at a job won’t

keep you top of mind for long. You need to think about developing more ‘touch points’ with your customers like newsletters, special offers,

service reminders, thank you notes and emails promoting new products or services.

Get Your Customers to Buy More Often - Customer retention is important because these people have bought from you

before, hopefully had a positive experience and simply need to be nurtured so they come back and buy again. It’s just poor business

practice to ignore an existing source of revenue that’s right under your nose and the nurturing process is designed to make customers feel

valued. Your communications are designed to help stay in touch (with newsletters and special offers) and keep your business top of mind.

Trades people rarely communicate with their clients beyond the first ‘sale’. Leaving a business card or fridge magnet behind at a job won’t

keep you top of mind for long. You need to think about developing more ‘touch points’ with your customers like newsletters, special offers,

service reminders, thank you notes and emails promoting new products or services.

![]() Increase the Average Sale Value - Batching or bundling several products together in a package deal is a way to make

your products and services appear more attractive and create extra value for your customers. Essentially you are offering a bundle of

products that cost less if they are purchased in a batch rather than if they were purchased individually. For example, a beauty therapist

might package up a facial with a massage and a moisturising cream. A clothing retailer might package up two shirts and a tie with every

suit sold. The products should be complimentary and we suggest you sit down and examine your product range to identify any opportunities to

bundle items together to make the package deal even more irresistible to your customers.

Increase the Average Sale Value - Batching or bundling several products together in a package deal is a way to make

your products and services appear more attractive and create extra value for your customers. Essentially you are offering a bundle of

products that cost less if they are purchased in a batch rather than if they were purchased individually. For example, a beauty therapist

might package up a facial with a massage and a moisturising cream. A clothing retailer might package up two shirts and a tie with every

suit sold. The products should be complimentary and we suggest you sit down and examine your product range to identify any opportunities to

bundle items together to make the package deal even more irresistible to your customers.

If you want to put your business under the microscope and explore ways to improve the profitability of your business, talk to us today. If you book a Business Accelerator session we will run your numbers through the Business Accelerator Program to quantify the profit improvement potential in your business plus provide a detailed report that includes 30 marketing strategies to help you achieve your goals.

This article forms part of our June 2018 Business Accelerator Magazine. Click HERE to download the full edition or browse other articles in this edition below:

Other Articles in this Edition:

- Looking For More Traffic To Your Website

- Thinking of Starting a Business?

-

Federal Budget 2018/19 Summary

- Changes for Individuals (3 Stage Personal Income Tax Plan, Preventing Bracket Creep, Removal of 37% Bracket, Medicare Levy Rates, Taxation of High Profile Individuals)

- Business Summary (Extension of $20,000 Instant Write-Off, Introduction of Cash Payment Limit, Expansion of Taxable Payments Reporting, Removal of Tax Deductibility for PAYG Payments Where Criteria isn't Met)

- Companies Summary (Phoenix Activity, Division 7A Changes, Research & Development Incentive)

- Trusts ( Children's Income & Testamentary Trusts, Circular Family Trust Distributions)

- Partnerships (Partners Accessing CGT Concessions)

- Superannuation (SMSF 3 year Audit Cycle, Maximum Number of Members, Voluntary Contributions Work Test Exemption, Concessional Cap Breaches, Deductions for Personal Contributions, Passive Fees - Banning Exit Fees - Small Accounts, Life Insurance)

- Other Tax Changes (Deny Deductions for Vacant Land)

IMPORTANT DISCLAIMER: This article contains general advice only and is prepared without taking into account your particular objectives, financial circumstances and needs. The information provided is not a substitute for legal, tax and financial product advice. Before making any decision based on this information, you should speak to a licensed financial advisor who should assess its relevance to your individual circumstances. While the firm believes the information is accurate, no warranty is given as to its accuracy and persons who rely on this information do so at their own risk. The information provided in this article is not considered financial product advice for the purposes of the Corporations Act 2001.